The Importance of Cryptocurrency Trading

Cryptocurrency trading has emerged as a significant component of the modern financial landscape. With the rapid proliferation of digital currencies and blockchain technology, understanding how to trade cryptocurrency is vital for both seasoned investors and newcomers alike. As of late 2023, over 200 million people are estimated to have traded cryptocurrencies worldwide, underpinning the relevance and potential of this market.

Current Trends in Cryptocurrency Trading

As the global economy evolves, so do the trends in cryptocurrency trading. In 2023, the increasing adoption of decentralized finance (DeFi) platforms and non-fungible tokens (NFTs) has driven substantial interest. Furthermore, major financial institutions are adopting trading strategies that involve cryptocurrency assets, reflecting a growing level of acceptance.

Moreover, regulatory frameworks are also shaping the cryptocurrency trading environment. Various countries are putting forth guidelines to ensure investor protection and market integrity. Recently, the European Union approved a comprehensive regulatory framework known as MiCA (Markets in Crypto-Assets), which is expected to influence trading practices significantly across member states. In contrast, countries with less stringent regulations may become more appealing to traders, creating a dichotomy in the market.

Tips for Successful Cryptocurrency Trading

Navigating the world of cryptocurrency trading can be overwhelming. Here are some essential tips:

- Educate Yourself: Ensure you have a solid understanding of blockchain technology and how trading works. Utilize online courses, webinars, and market analysis to build your knowledge.

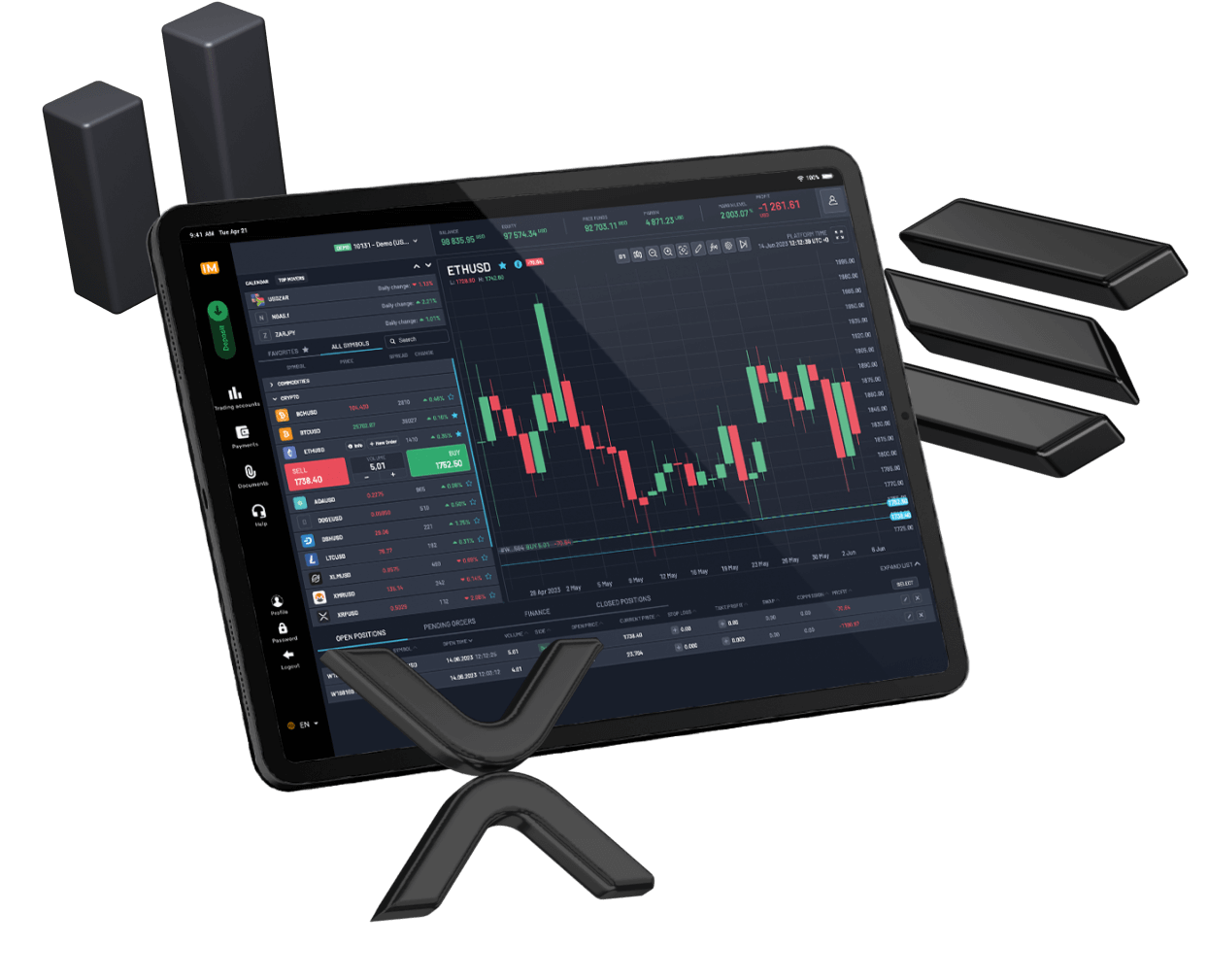

- Choose the Right Exchange: Selecting a reputable cryptocurrency exchange is crucial. Investigate fees, security measures, and available currency pairs before committing.

- Practice Risk Management: Cryptocurrency markets are notoriously volatile. Implement risk management strategies such as setting stop-loss orders to protect your investments.

- Diversify Your Portfolio: Don’t put all your resources into one cryptocurrency. Diversification can mitigate risk and improve potential returns.

Conclusion

As cryptocurrency trading continues to gain traction, it remains essential for investors to stay informed about market trends, regulatory changes, and trading strategies. The year 2023 presents a unique landscape filled with opportunities and challenges. For traders, understanding these dynamics is critical not just for immediate gains but also for long-term success in the evolving field of cryptocurrency. With continued advancements in technology and increasing mainstream acceptance, the future of cryptocurrency trading appears promising.